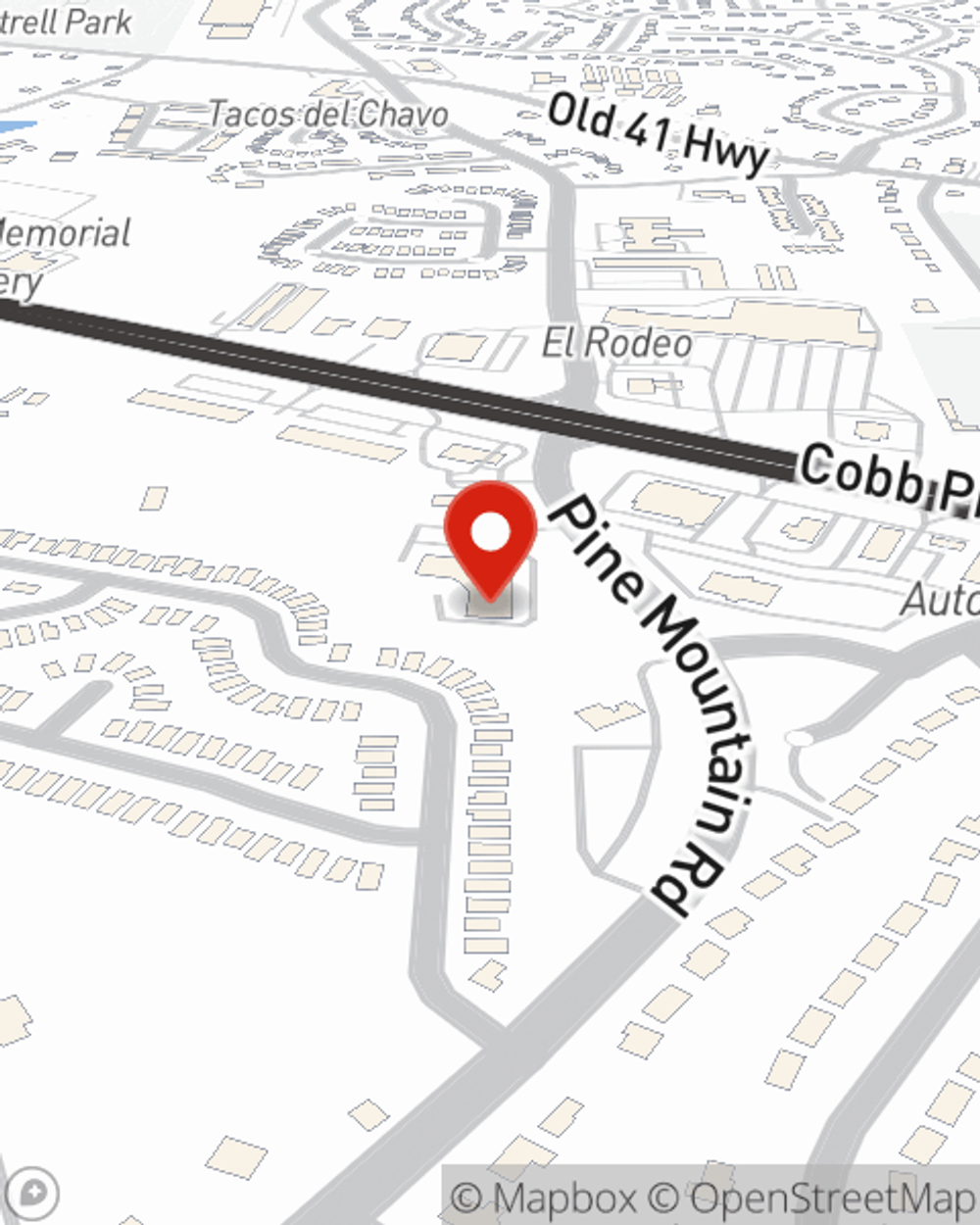

Business Insurance in and around Kennesaw

One of the top small business insurance companies in Kennesaw, and beyond.

This small business insurance is not risky

- Kennesaw, GA

- Marietta, GA

- Woodstock, GA

- Acworth, GA

- Canton, GA

- Rome, GA

- Smyrna, GA

- Powder Springs, GA

- Roswell, GA

- Milton, GA

- Alpharetta, GA

- Cartersville, GA

- Adairsville, GA

- Calhoun, GA

- Douglasville, GA

- Villa Rica, GA

- Atlanta, GA

Help Prepare Your Business For The Unexpected.

Running a small business comes with a unique set of highs and lows. You shouldn't have to face those alone. Aside from just your family and friends, let State Farm be part of your line of support through insurance options including a surety or fidelity bond, errors and omissions liability and business continuity plans, among others.

One of the top small business insurance companies in Kennesaw, and beyond.

This small business insurance is not risky

Insurance Designed For Small Business

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance coverage by small business owners like you. You can work with State Farm agent Rick Mottern for a policy that safeguards your business. Your coverage can include everything from business continuity plans or a surety or fidelity bond to employment practices liability insurance or mobile property insurance.

Get right down to business by getting in touch with agent Rick Mottern's team to discuss your options.

Simple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Rick Mottern

State Farm® Insurance AgentSimple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.